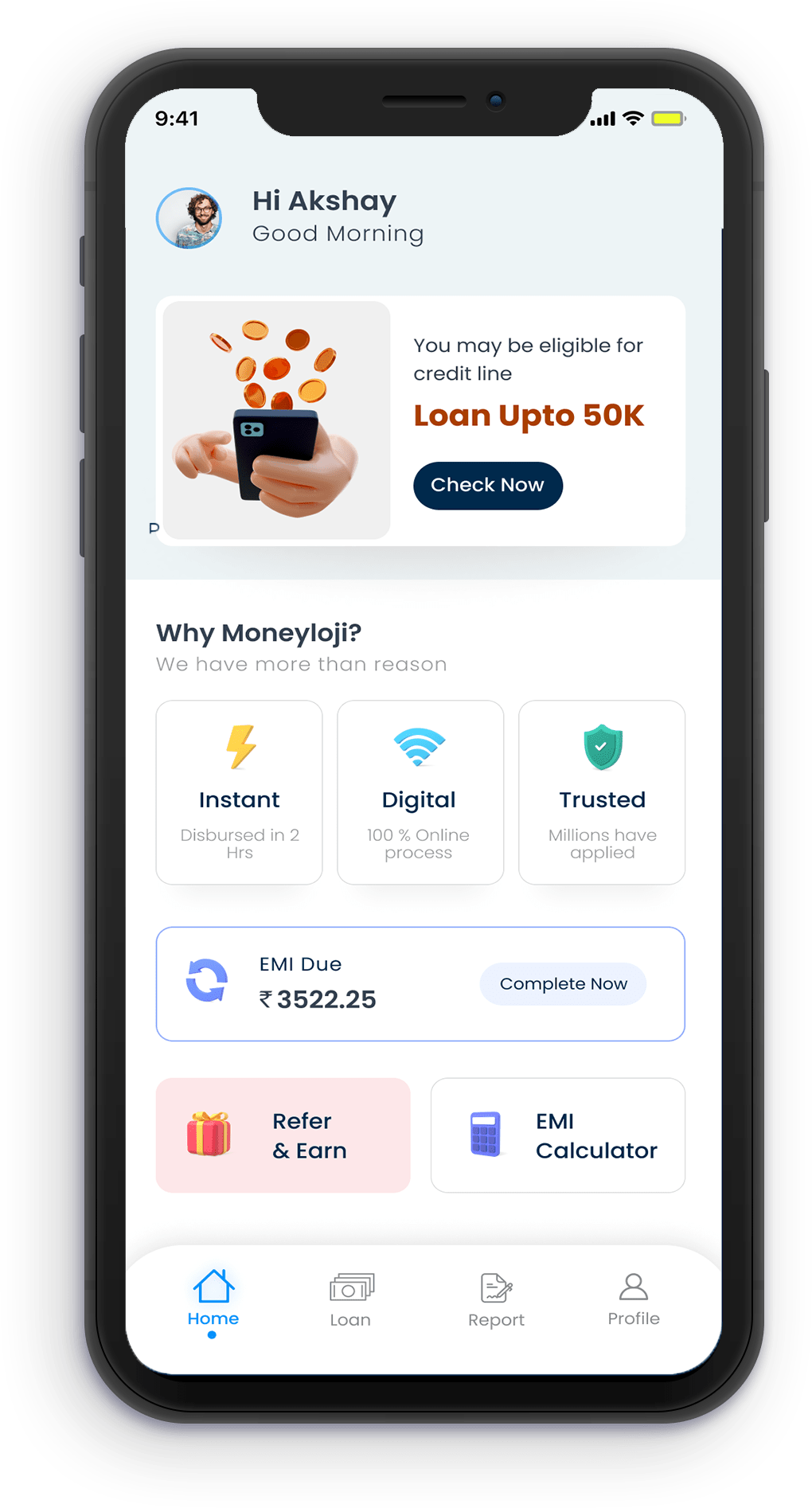

Loan Lending App Development Company in UAE

Advance Base System designs and develops Loan Lending Apps for users to borrow money directly from lenders and also allows easy and fast finance options. If you are looking to build a loan lending app, please reach out to us.

Loan System On Demand Development

At Advance Base System, the best loan lending app development company in UAE, we specialize in building fintech and consumer apps that run seamlessly on various platforms such as Android, iOS, and the web. We have the experience and the expertise to create the right product for you, which will help you grow your loan lending business by increasing your customer base.

Custom Development

We create custom loan lending apps that cater to your organization’s specific needs.

Custom Credit Score Mechanism

Lenders can easily integrate a credit score service provider to the money lending mobile apps we design through the in-built custom credit score mechanism.

eNach Enabled

The state-of-the-art loan lending applications that we build come with eNach feature to enable the processing of mandates digitally.

In-app Payment Gateway

The payment gateway we integrate with the app allows customers to pay without leaving the loan lending marketplace.

-

1

Launch Quickly

Expert developers at Advance Base System

have the capability to design, develop, and launch your loan system software solution quickly. In fact, our turnaround time for delivering top-class solutions beats that of most players in the field. -

2

Cost-effective Solution

We create affordable custom loan lending apps that both money lenders and loan seekers can use without any hassles. When you associate with us, you get the best loan lending software that does not create a dent in your pocket.

-

3

Extensive Experience

At Advance Base System, the top mobile app development company in UAE, we have a team of developers who have extensive experience in crafting solutions for a variety of businesses across the globe.

-

4

Highly Scalable

At Advance Base System, we are committed to designing loan lending apps that are not only flexible but also highly scalable. Besides, they help you to quickly adapt to ever-changing market conditions and customer needs.

Happy Customers

Experienced Developers

Mobile Apps Completed

Office Locations

Frequently Asked Questions

Top Loan Lending App Development Company in UAE

Advance Base System is by far the leading loan lending app development company in UAE. If you are looking to develop a comprehensive software application for your fin-tech business, you have come to the right place. We design and develop online loan lending apps similar to those used by top digital lending companies such as Lendingkart, Capital Float, MoneyTap, etc. UAE’s digital lending market is expected to grow to $350 billion by 2023. This explains the high demand for money lending apps in UAE. Unlike many other industries, the digital loan lending sector allows multiple players to take part in the growth. If you are planning to launch a modern loan lending platform of your own, you can contact us and we will provide you with a free quote.

Advance Base System’s Loan Lending App Development Services

As the best loan lending app development company in UAE, we offer customized solutions for all our clients. The app helps them handle different types of products such as student loans, personal loans, start-up/small business loans, mortgages/home loans, and car loans. The key features of the apps we develop include:

- Check credit score with CIBIL or using bank statement

- eNach enabled for loan repayment

- Customer admin dashboard

- Chatbot for customer support

- Loan and interest calculator

- CMS integration

- Support for multiple currencies and languages

- Analytics

USPs of Advance Base System’s Loan Lending App Development Services

At Advance Base System, we also allow companies that want to build loan lending application software to hire dedicated developers from our talent pool. As our team members have diversified experience, they will be able to build the right product for you after analysing your business model. The USPs of our app development services are:

- Comprehensive solutions after a thorough market study and user experience analysis

- Multi-platform development capability (Web, iOS, Android)

- Multiple payment gateway solution integrations

- Automatic payout systems

- Custom admin panel that comes with a top-class CMS for clients